Recent developments

In June 2020 I participated in a webinar, hosted by the Adam Smith Institute, about NGDP targeting. I wouldn’t expect you to watch the entire recording, but it was a real thrill to share a panel with Scott Sumner.

In September 2021 Scott Sumner was interviewed by Larry White for the Mercatus Center podcast. I recommend the whole episode, but what I found most interesting was Scott’s optimistic take on the influence of NGDP targets. He made a few key points:

- A flexible average inflation target is one way to permit NGDP playing a role without the embarrassment of abandoning an inflation target.

- The Fed’s decision to cut interest rates in 2019, despite inflation being high, indicates an increased concern for market expectations (see falling inflation expectations here) and therefore a triumph of market monetarism. (Indeed market monetarists have been credited with having directly influenced the Fed’s decision to adopt average inflation targeting and use market forecasts when cutting interest rates in 2019).

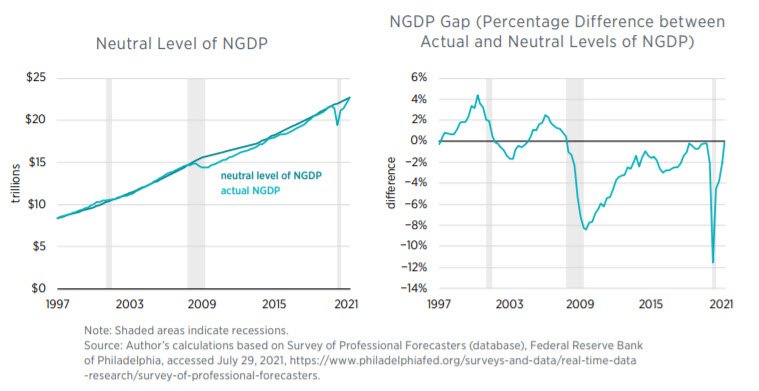

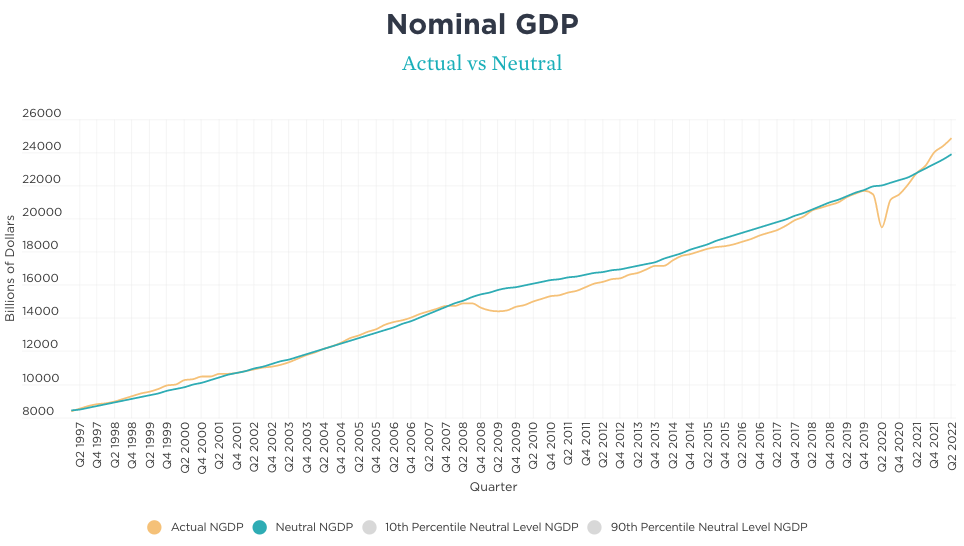

- We’ve now got back to the pre-covid NGDP trendline (see David Beckworth’s charts, shown below) which is why this recession hasn’t prompted a debt crisis.

I don’t think this final point is appreciated enough – we’ve experienced a historically unprecedented collapse in economic activity and yet this didn’t have an immediate, obvious, and cataclysmic effect on the banking system, the housing market, unemployment, or corporate or personal bankruptcy levels. Had central banks repeated the mistake of 2008, and allowed NGDP growth expectations to fall, then the consequences would have been horrific. But they heeded the lesson, and reassured markets that NGDP would soon return to the previous trend path.

That said, if we look at the figures for 2022 we can see that according to David Beckworth’s excellent data set actual NGDP is now exceeding the amount it would be in order to be neutral. This suggests that the Fed are providing too much support, risking higher inflation and financial exuberance.

Source: David Beckworth. https://www.mercatus.org/publications/monetary-policy/measuring-monetary-policy-ngdp-gap

Whether or not central banks adopt an explicit NGDP target this data is playing a crucial role in our attempt to assess and inform policy decisions. I’m proud to have contributed to this research agenda.